Assessment Department

Assessment Department Quick Links

NYS Department of Taxation & Finance

The Assessor will:

- Set up an appointment to meet anyone who is not physically able to come to the Town Office to complete required forms.

- Calculate the assessed value (or market value) of homes within the Town of Canandaigua

- Provide the following publicly available information about a property upon request:

- Owner's name(s)(current and previous)

- Assessed value of home

- Year Built

- Last sale price

- Review eligibility for and provide information about tax exemptions such as:

Check out this short video explaining property taxes and the role of the Assessor's Office.

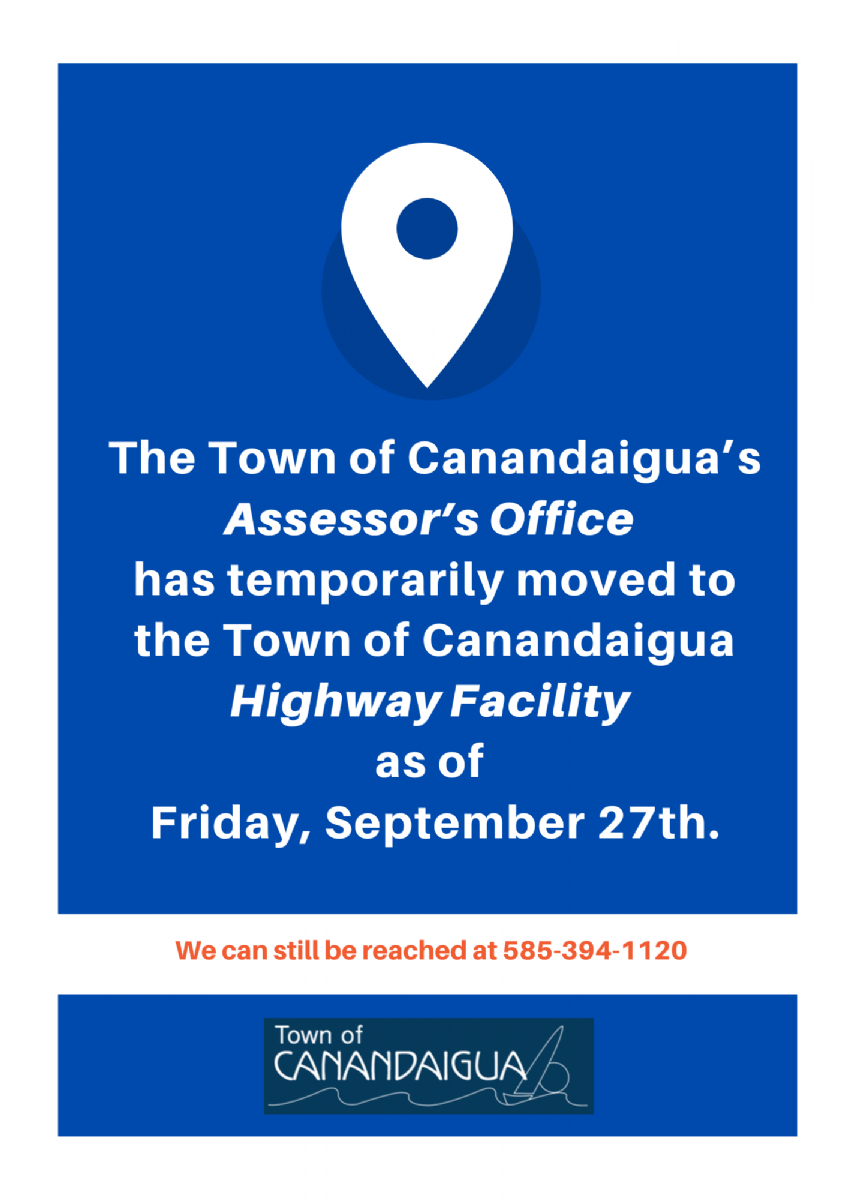

OFFICE HOURS

Monday - Friday 8:00am - 4:00pm

Mailing Address:

5440 Route 5 & 20 West

Canandaigua, NY 14424

Stop in with any questions.

DEPARTMENT CONTACTS